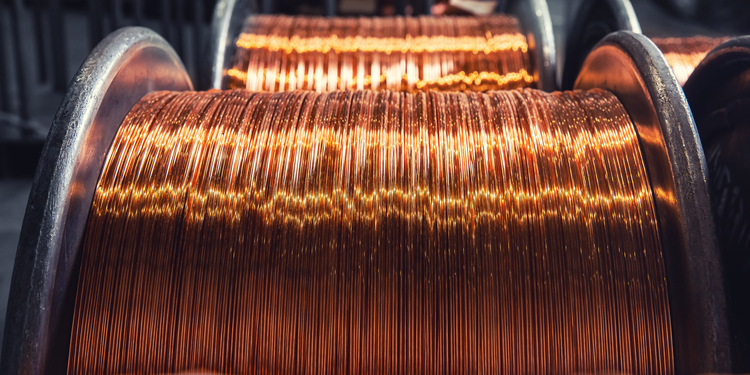

Zijin Mining Group, China’s largest metals producer, reported a 52% increase in net profit for 2023, fueled by higher production and surging copper and gold prices.

Strong Financial Performance

The company posted a net income of 32.1 billion yuan ($4.4 billion), in line with its earlier forecast of 32 billion yuan, while revenue rose 3.5% to 303.6 billion yuan.

Over the past decade, Zijin has aggressively expanded its global footprint, securing major copper projects in China and the Democratic Republic of Congo to strengthen its position in the global metals market.

Navigating Market Challenges

As critical mineral security becomes a growing geopolitical concern, Chairman Chen Jinghe reaffirmed Zijin’s commitment to boosting competitiveness and mitigating risks in a volatile market.

However, despite strong financial results, Zijin has revised some of its production targets:

- Copper production for 2024 has been cut by 6% to 1.15 million tons.

- Lithium production has faced hurdles, with small volumes in 2023 and a sharp 60% reduction in its 2025 output target to 40,000 tons.

The company’s global expansion efforts have also encountered regulatory challenges, as Western markets impose greater scrutiny on Chinese acquisitions.

Outlook Remains Strong

Despite these adjustments, analysts remain bullish on Zijin’s growth trajectory. The company is expected to meet its five-year targets by 2028, with:

- Copper output increasing by 58%

- Gold production rising by 62%

Amid shifting market dynamics and geopolitical tensions, Zijin remains a powerhouse in the global metals industry, positioning itself for sustained long-term growth.