The Central Bank of Congo (BCC) has released its latest economic outlook for the period of January 31 to February 7, 2025, revealing notable shifts in key commodity prices that reflect global market forces and geopolitical developments.

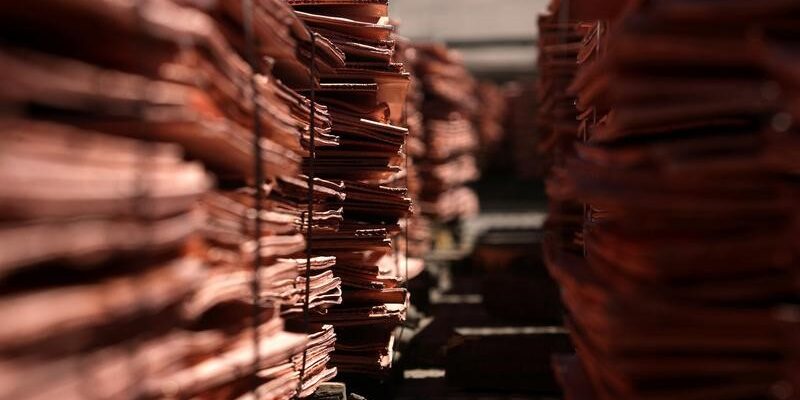

Copper Surges Amid Trade Policy Adjustments

Copper prices climbed to $9,412.75 per tonne, recording a 3.68% increase in just one week. The rise is fueled by renewed market confidence following the U.S. government’s decision to delay new tariffs on imports from major trade partners like Canada, Mexico, and China. Year-to-date, copper has gained an impressive 7.10%, signaling strong demand and positive investor sentiment.

Cobalt Faces Pressure from Oversupply

While copper shines, cobalt continues to struggle. Prices dropped by 2.87% in a week, settling at $23,346.00 per tonne due to persistent oversupply in the market. Since the end of December 2024, cobalt has declined by 2.93%, reflecting weaker demand and increased production.

Gold Soars on Global Uncertainty

Gold reaffirmed its status as a safe-haven asset, surging 3.92% weekly to reach $2,868.78 per ounce. The surge comes amid rising geopolitical tensions and economic uncertainties, driving investors toward the precious metal as a hedge against risk.

Key Takeaway: Global Trends Impact the DRC’s Commodity Market

The BCC’s report highlights how trade policies, geopolitical risks, and supply-demand imbalances continue to shape commodity markets, directly impacting the Democratic Republic of Congo’s key exports. As 2025 unfolds, businesses and investors will be closely watching how these factors evolve and influence pricing trends in the mining sector.

Stay tuned for more updates on the latest market dynamics shaping Africa’s mining and industrial landscape.